With the advent of technology and the digitization of government services, you can now apply for Employee Provident Fund (EPF) withdrawal online through the Unified Member Portal provided by the Employees' Provident Fund Organisation (EPFO). Here are the steps to withdraw your EPF online:

Activate Your UAN (Universal Account Number): Ensure that your UAN is activated, and your KYC details, including your Aadhar, PAN, and bank account information, are updated and verified by your employer. This is necessary for online EPF withdrawal.

Visit the EPFO Unified Member Portal: Go to the official EPFO Unified Member Portal at https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

Log In: Log in to your account using your UAN and password.

Check KYC Details: Ensure that your KYC details are correct and updated. You can verify this information in the 'Profile' section.

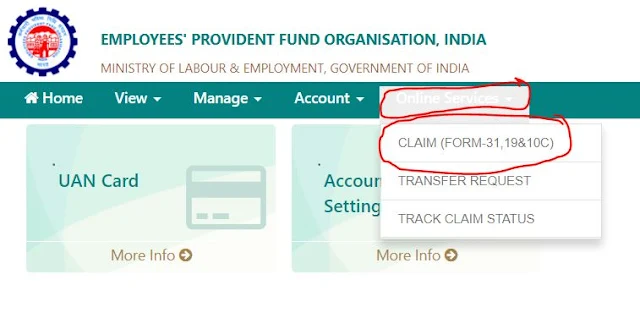

Click on 'Online Services': From the main menu, click on the 'Online Services' tab.

Select 'Claim (Form-31, 19 & 10C)': Under the 'Online Services' menu, choose 'Claim (Form-31, 19 & 10C).'

Verify Personal Details: Your personal details will be displayed. Ensure that your bank account details are correct for the transfer of funds. If not, update your bank account information in the 'Manage' section.

Select the Type of Claim: You will be asked to select the type of claim you want to make (e.g., full withdrawal, partial withdrawal, pension withdrawal). Choose the appropriate option.

Enter the Required Details: Fill in the necessary details based on the type of claim you selected. Provide details like the reason for withdrawal, the number of years in service, and the amount required. Upload any supporting documents if required.

Preview the Claim: Review the claim details for accuracy.

Authenticate the Claim: To complete the withdrawal process, you will need to authenticate the claim using an OTP (One-Time Password) sent to your registered mobile number.

Submit the Claim: After authentication, submit your claim.

Track the Claim: You can track the status of your EPF withdrawal claim through the EPFO portal. Once the claim is approved, the amount will be transferred to your registered bank account.

It's important to note that the withdrawal process may take some time, and the duration can vary based on the complexity of the claim and the processing times of the EPFO. It's advisable to regularly check the status of your claim on the EPFO portal for updates.

Rule for PF advance for COVID-19

75 per cent of the amount standing to your credit in the account, or three months of Basic+DA, whichever is lower.

The application can be made online through EPFO portal.

The application for COVID-19 claim is allowed even if any other advance is pending.

PF advance for COVID-19 can be claimed only once.

How to claim PF advance for COVID-19?

a. Login to Member Interface of Unified Portal

(https://unifiedportalmem.epfindia.gov.in/memberinterface)

b. Go to Online Services>>Claim (Form-31,19,10C & 10D)

c. Enter your Bank Account and verify

d. Click on “Proceed for Online Claim”

e. Select PF Advance (Form 31) from the drop down

f. Select purpose as “Outbreak of pandemic (COVID-19)” from the drop down

g. Enter amount required and Upload scanned copy of cheque and enter your address

h. Click on “Get Aadhaar OTP”

i. Enter the OTP received on Aadhaar linked mobile.

j. Claim is submitted.

An individual can check the whether the service period got transferred or not on EPFO's member sewa portal.

An individual can check his past and current service details under the service history tab on the member's e-Sewa portal.

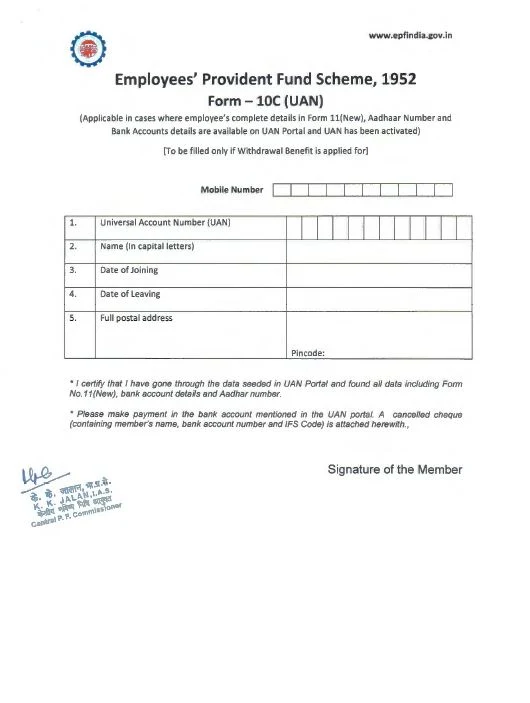

UAN Enabled EPF Withdrawal Online if Aadhar, PAN, and Bank KYC updated PF Partial withdrawal Rule 19,10C and for advance form 31

Now, employee can submit their PF claim for withdrawn/Advance with new form 19 UAN,10C UAN & 31UAN directly to the commissioner without employer attestation, It is applicable for those employees whose details like Aadhaar number and Bank account number have been seeded in thier UAN and whose UAN have been activated and their KYC have been verified by the employer.

All other employees who not full filling the above condition shall continue to make their claims of withdrawn/Advance in existing form 19, 10C & 31.

EMPLOYEE PROVIDENT FUND- PF Partial withdrawal Rule

The Employees' Provident Fund (EPF) allows partial withdrawals, also known as advances, under specific circumstances as per the EPF rules. These partial withdrawals are intended to provide financial assistance to EPF members during times of need. Here are the common rules and conditions for making a partial withdrawal from your EPF account:

Partial Withdrawal Reasons: Partial withdrawals are allowed for specific purposes such as medical treatment, marriage, education, purchase/construction/renovation of a house, and repayment of a home loan.

Eligibility Criteria: To be eligible for a partial withdrawal, you need to meet specific conditions for each type of withdrawal. For example:

- Medical Treatment: You can withdraw up to six times your monthly basic wages or the total employee share with interest, whichever is lower.

- Marriage: You can withdraw for your or your siblings' marriage, and you should have completed seven years of service.

- Education: You can withdraw for your children's education after seven years of service.

- Purchase/Construction/Renovation of House: You can withdraw after five years of service.

- Home Loan Repayment: You can withdraw to repay a home loan if you have completed ten years of service.

Maximum Withdrawal Limit: The maximum amount you can withdraw is subject to certain restrictions, and it depends on the specific reason for withdrawal. You can withdraw a certain percentage of your total EPF balance.

Advances / WithdrawlsAdvance/ Withdrawals may be availed for the following purposes : Marriage / Education Treatment Purchase or construction of Dwelling house Repayment of Housing Loan Purchase of Plot Addition/Alteration of House Repair of House Lockout Withdrawal Prior to Retirement Other Advances Notes For Marriage / Education

|

| Type of Advance | Purpose | Eligibility | Maximum Admissible Amount** | Proof/ documents required |

| Under Para 68-j of the Scheme Whenever required for treatment | For the treatment of :

|

| 6 times of Wages OR Full of Employee share (whichever is less) | Certificates of proof as mentioned in the eligibility column Apply in Form-31 through the Employer |

| Type of Advance | Purpose | Eligibility | Maximum Admissible Amount** | Proof/ documents required |

| Under Para 68-B of the Scheme Only Once (either 'construction or purchase of house' or 'repayment of housing loan) Apply in Form-31 | For the construction/ purchase of dwelling unit (house/ flat) |

| 36 times of Wages | Declaration in the Proforma obtained along with application signed by Member Apply in Form-31 through Employer |

| Type of Advance | Purpose | Eligibility | Maximum Admissible Amount** | Proof/ documents required |

| Under Para 68-BB of the Scheme Only Once (either 'construction or purchase of house' or 'repayment of housing loan) Apply in Form-31 | Repayment of housing loan |

| 36 times of Wages | Declaration in the Proforma obtained with approval and signed by the Member Apply in Form-31 through the Employer |

| Type of Advance | Purpose | Eligibility | Maximum Admissible Amount** | Proof/ documents required |

| Under Para 68-B of the Scheme Only Once | For the purchase of site/ plot |

| 24 times of Wages | Filled-up Declaration(from the Employee in the prescribed form and enclosed with the application. Copy of the Purchase Agreement Apply in Form-31 through the Employer |

| Type of Advance | Purpose | Eligibility | Maximum Admissible Amount** | Proof/ documents required |

| Under Para 68-B(7) of the Scheme Only Once Apply in Form-31 | Addition/alteration of house (same type of advance can be availed for repair of house) |

| 12 times of Wages | Certificates of proof Apply in Form-31 through the Employer |

| Type of Advance | Purpose | Eligibility | Maximum Admissible Amount** | Proof/ documents required |

| Under Para 68-B(7) of the Scheme Only once | Repair of house (same type of advance can be availed for alteration of house) |

| 12 times of Wages | Certificates of proof Apply in Form-31 through the Employer |

| Type of Advance | Purpose | Eligibility | Maximum Admissible Amount** | Proof/ documents required |

| Under Para 68-H of the Scheme Whenever need arises | Lockout or closure of the establishment |

| equivalent to the total of wages multiplied by no. of months closed | Declaration Apply in Form-31 |

| Type of Advance | Purpose | Eligibility | Maximum Admissible Amount** | Proof/ documents required |

| Under Para 68-NN of the Scheme Only once | Withdrawal prior to retirement |

| 90% of total of both shares | Certificate from the employer showing the date of retirement Apply in Form-31 |

No comments:

Post a Comment