How to create Health ID?- हेल्थ आई डी कार्ड कैसे बना सकते है।

हेल्थ आईडी (Health ID) कार्ड बनाने के लिए आपको अपने स्वास्थ्य सेवा प्रदाता या स्वास्थ्य संगठन की वेबसाइट पर जाकर उनके निर्दिष्ट प्रक्रिया का पालन करना होगा। विभिन्न देशों और स्वास्थ्य संगठनों में हेल्थ आईडी कार्ड की प्रक्रिया और विधि में अंतर हो सकता है, इसलिए आपको अपने अधिकारी स्वास्थ्य संगठन की आधिकारिक वेबसाइट पर जाकर सही जानकारी प्राप्त करनी चाहिए। यहां कुछ आम चरण हैं जिन्हें आपके लिए सहायक साबित हो सकते हैं:

स्वास्थ्य सेवा प्रदाता चयन करें:

- सबसे पहला कदम यह है कि आपको उन स्वास्थ्य सेवा प्रदाताओं का चयन करें जिनके साथ आप अपना हेल्थ आईडी कार्ड बनाना चाहते हैं। यह सेवा सरकारी या निजी स्वास्थ्य सेवा प्रदाताओं द्वारा प्रदान की जा सकती है।

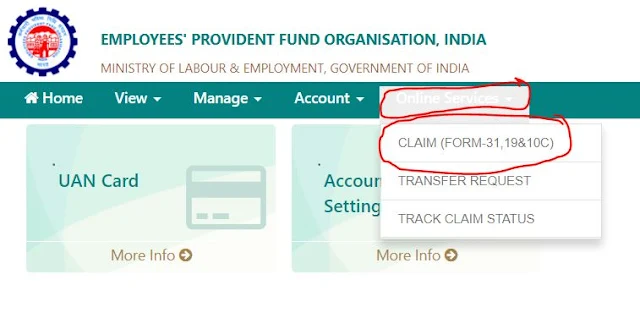

आधिकारिक वेबसाइट पर जाएं:

- आपके चयनित स्वास्थ्य सेवा प्रदाता की आधिकारिक वेबसाइट पर जाएं।

साक्षरित या निर्माण करें:

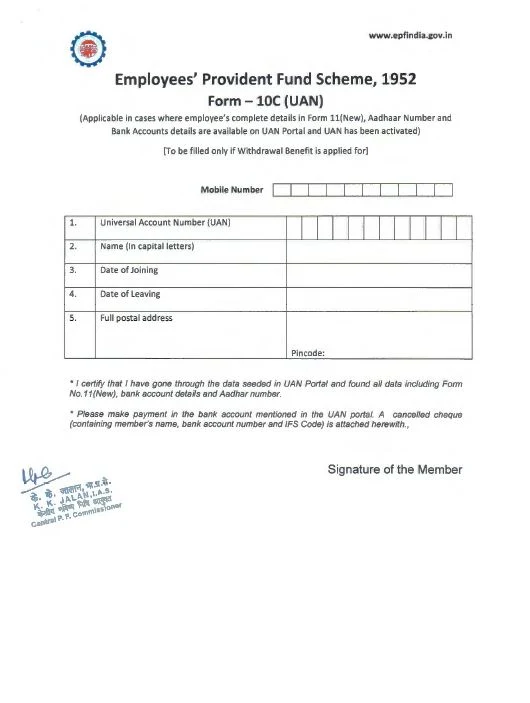

- वेबसाइट पर, आपको अकाउंट बनाने के लिए विशेष विधियों का पालन करना होगा। आपको आपके व्यक्तिगत जानकारी, स्वास्थ्य रिकॉर्ड, आदि को अपलोड करने की संभावना होती है।

हेल्थ आईडी कार्ड बनाएं:

- आपके द्वारा प्रदान की गई जानकारी के आधार पर, आपका हेल्थ आईडी कार्ड बनाया जाएगा। इसके बाद, आपको एक यूनिक हेल्थ आईडी नंबर प्राप्त होगा।

हेल्थ आईडी कार्ड डाउनलोड करें:

- एक बार हेल्थ आईडी कार्ड बन जाने के बाद, आप अकाउंट से लॉगिन करके अपने कार्ड को डाउनलोड कर सकते हैं या प्रिंट कर सकते हैं।

कार्ड का प्रिंट:

- आपको कार्ड का प्रिंट निकालकर सुरक्षित रखना चाहिए जिससे आपके स्वास्थ्य डेटा की सुरक्षा हो सके।

कृपया ध्यान दें कि हेल्थ आईडी कार्ड की प्रक्रिया और विधियां विभिन्न देशों और स्वास्थ्य सेवा प्रदाताओं में भिन्न हो सकती हैं, इसलिए आपको अपने चयनित सेवा प्रदाता की आधिकारिक वेबसाइट पर जाकर निर्दिष्ट जानकारी प्राप्त करनी चाहिए।